Tax consultants and auditors in Münster, Oelde and Steinfurt

We are active in the field of tax consulting and auditing throughout Germany!

Is your next tax return due? Is the bookkeeping for your company growing? Or are plans to set up a company becoming more and more concrete? Then you need a competent partner at your side that you can rely on at all times. ATC Münster GmbH is your expert for tax advice, auditing and consulting with offices in Münster, Oelde and Steinfurt!

With our many years of experience and specialized expertise, we support private individuals, companies, doctors, online traders, non-profit entrepreneurs and property owners in all areas of tax consulting. Our team of experienced tax advisors and auditors offers you tailor-made, strategic concepts that create added value for your finances. Through transparency, clear communication and absolute reliability, we maintain a trusting working relationship. Take advantage of our comprehensive industry knowledge for your success.

Translated with DeepL.com (free version)

We are happy to advise and support you in the following areas:

- Tax return

- consulting

- Bookkeeping

- Auditing

- Services

We offer these tax consultant services

A tax consultant is generally the first point of contact when it comes to the following areas:

- Tax advice

- tax returns

- Annual financial statements

- business start-ups

- Company succession

- Investment advice

- Business consulting

Frequently asked questions to the tax office

Before you visit a tax office for the first time, you will certainly ask yourself a few questions. We answer some of them below. If you have any further questions, we are of course at your disposal.

What are the tasks of a tax advisor?

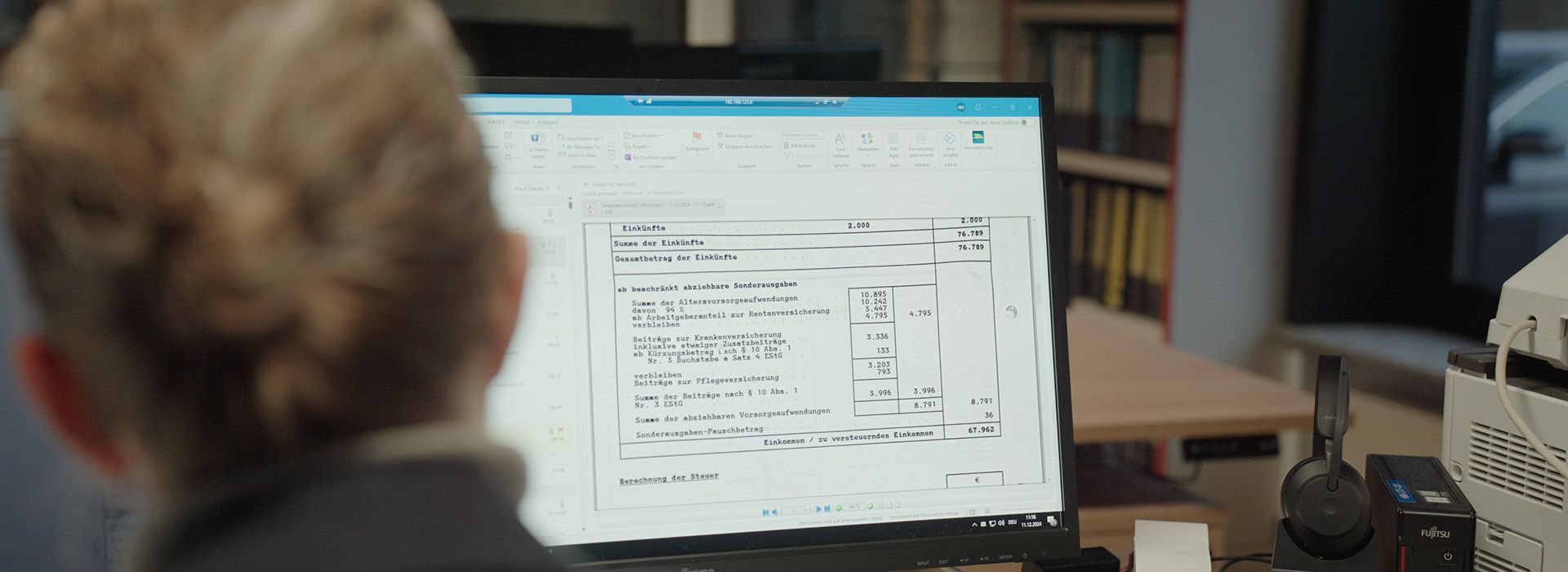

A tax consultant takes care of all matters relating to tax advice. This includes the preparation of tax returns and annual financial statements, the organization of bookkeeping and payroll accounting, representation before tax authorities and general advice and representation in tax matters.

How much does a consultation with a tax advisor cost?

The fees for tax consultancy services are set out in the Tax Consultant Remuneration Ordinance (StBVV).

How often should you visit a tax advisor?

The tax return and the annual financial statements are required once a year. Activities such as ongoing bookkeeping, on the other hand, take place regularly.

When is it necessary to consult a tax advisor?

A tax advisor should be consulted if support is required in the areas mentioned - regardless of whether you are a private individual or an entrepreneur.

What documents are required for the tax return?

To prepare your tax return, you should bring your current income tax statement, your most recent tax assessment notice, your tax identification number, your identity card and, if applicable, bank statements.

Tax advice, consulting and accounting under one roof

Tax advice, consulting and accounting under one roof

Our USP lies in the comprehensive overall package of services that we offer you from a single source. By integrating all internal company data, we guarantee high efficiency and cost savings. We have a generalist approach and train our employees to be able to offer you a wide range of services competently. For you, this means that you can concentrate fully on your operational business without having to worry about coordination or additional service providers. You benefit from optimized processes and a significant reduction in workload..